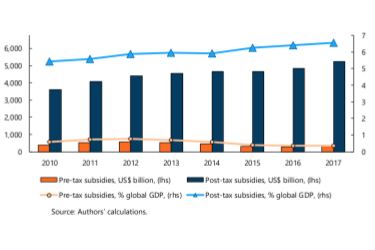

Fossil fuel subsidies cost governments around the world over 5 trillion dollars every year. This staggering number accounts for more than just government to corporation cash by factoring in the costs of externalities, which account for social and environmental harms resulting from fossil fuel extraction and use around the world.

Pre-Tax Subsidies vs. Post-Tax Subsidies:

Fossil fuel subsidies, as described by the IMF, can be broken down into two groups: pre-tax and post-tax. A pre-tax subsidy follows the definition that is more commonly known: the difference between what people pay for fossil fuel and what companies spend to produce it. A post-tax subsidy is more holistic in its financial considerations, factoring in the difference between fuel prices and ‘actual consumer fuel prices’, which include the social and environmental costs associated with fossil fuel use, such as health risks, pollution, etc.

Post-tax subsidies incorporate externalities, accounting for the ‘invisible’ costs of the fossil fuel industry. These less apparent consequences cost governments tremendous amounts of money in some indirect manner, and are on the rise despite a general decrease in pre-tax fossil fuel subsidies.

Think of it this way: a government may pay 10 million dollars to a fossil fuel company as a direct subsidy, but then spends another 5 million on healthcare in response to widespread asthma and other pollution related illnesses. These less apparent consequences too reflect government dollars spent on and for the fossil fuel industry, and therefore are factored into the cost of FF subsidies.

This graph shows the upward trend of post-tax subsidies, in addition to the percent of GDP consumed by these fossil fuel associated costs.

Invest this money instead in renewables!

So… if these pre-tax subsidies were granted instead to renewable energy causes, global governments would save lots of money from the related decline of the costly post-tax subsidies. Not only do subsidies on renewables make these systems more accessible and affordable, but then indirectly reduce the externality costs of fossil fuels. If government dollars are spent on renewable energy development instead of fossil fuels, a widespread decrease in post-tax subsidies and externality costs would occur. Governments supporting renewables are governments that will fight climate change and save money, and corporations like Ipsun Solar can help to grow sustainably, adding to the ever increasing benefits of going solar!