If you have solar, you know that owning an electric vehicle is a no-brainer for greening your lifestyle and saving loads of cash. But if you tried to buy an EV in the past couple of years, you’ve probably also run into long waitlists, lack of choice, and manufacturers who have hit their cap for rebates. Thankfully, the passage of the Inflation Reduction Act (IRA) is changing this.

The bill introduced consistent tax credits for consumers over the next ten years, and over $60 billion for manufacturing. Read on to learn what the tax credits mean for you, and to see which vehicles may or may not be covered.

First, let’s take a quick look at the big picture of the IRA in regard to EVs…

How Does the Inflation Reduction Act Help EV Adoption?

The IRA is a historic bill that includes new tax credits for a host of climate-friendly technologies including solar, wind, EVs, home electrification, and much more. It’s paving the way for a huge boom in solar, which is super exciting, but we also love the massive momentum it’s creating for EVs.

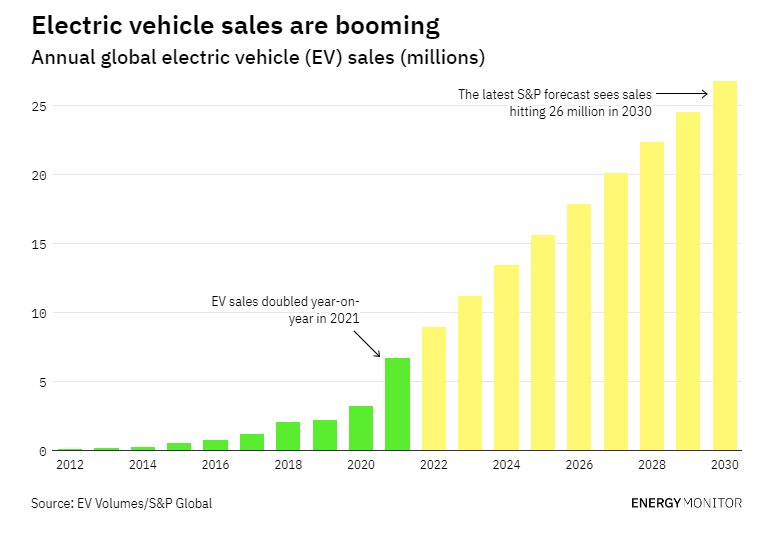

Even before the IRA, there was great movement towards electrifying personal and fleet vehicles. According to the International Energy Agency, sales of electric cars (including fully electric and plug-in hybrids) doubled in 2021 to a new record of 6.6 million, according to the latest edition of the annual Global Electric Vehicle Outlook.

Now with the passage of the IRA, that momentum is set to explode, both for consumers and manufacturers. The bill includes a $10 billion investment tax credit to build domestic clean technology manufacturing facilities, such as electric vehicle plants, and wind turbine and solar panel manufacturing facilities. Another $2 billion in grants is available for retooling existing auto manufacturing facilities to produce clean vehicles. Additionally, the IRA provides up to $20 billion in loans to build new clean vehicle manufacturing facilities. These incentives should eventually boost manufacturing and make EV waitlists a thing of the past.

You can get an idea of your personal savings potential if you purchase various green home technologies, including an EV or an EV charging station, with this cool IRA calculator from Rewiring America:

Now let’s get down to specifics. If you’re looking to purchase an EV, it’s a great time to do it. Read on below to see what will work best for your situation. Here are the changes the IRA brought for EVs:

New Electric Vehicle tax credits

People who purchase a new electric vehicle after December 31, 2022, are eligible for up to a $7500 tax credit, but income requirements and new guidelines may make many people and/or certain vehicles ineligible for the entire credit.

The previous $7,500 tax credit, which was in effect through December 31, 2022, did not have limitations on income, price, or battery component sourcing, but it did have a cap that manufacturers were starting to reach. Now that the Inflation Reduction Act has been signed into law, the credits will be more predictable and consistent, but the qualifications are also more stringent. Here are all of the changes for new EV buyers:

Final assembly in North America: Effective immedately, in order for the vehicle to qualify, its final assembly must be in North America. That limitation allows vehicles such as the Ford F-150 Lightning electric pickup, Lincoln Corsair Grand Touring PHEV and Jeep Grand Cherokee 4xe PHEV to qualify for the credit. It also allows the Chrysler Pacifica Hybrid, a PHEV built in Canada and the Ford Mustang Mach-E, which is assembled in Mexico, to qualify.

- Currently, a few foreign nameplate automakers build EVs in North America. The Nissan Leaf is made in Symrna, Tennessee, and the Volvo S60 Recharge is produced in South Carolina. Production of the Volkswagen ID.4 was started outside of the U.S. but has recently moved to Chattanooga, Tennessee. The IRS will rely on a car’s vehicle identification number, or VIN, to decide its country of origin.

- Visit the Alternative Fuels Data Center for a larger list of which vehicles are eligible for the credit.

- And check out this recent CNN/NBC story about eligible vehicles for a quick primer.

Household income requirement: Households with an adjusted gross income up to $300,000 will still qualify for the credit, while heads of household must be below $225,000 and individual filers will qualify only with income below $150,000.

Vehicle Manufacturers Suggested Retail Price (MSRP) requirement: Only vehicles that cost below a certain amount will qualify. For SUVs, pickup trucks, and vans, the threshold is $80,000. For sedans, hatchbacks, wagons, and other vehicles, the credit cuts off at $55,000.

Phased-in battery component and mineral sourcing requirements:

Starting in 2023, each half of the credit (up to $3,750) you can receive will depend on two other factors — where the battery components are made and where the raw materials used in the production of the battery come from.

Battery equipment manufactured and assembled in US: In 2023, 50% of the EV battery’s components must come from the U.S. or another country that has a free-trade agreement with the United States. In 2024 and 2025, that percentage goes to 60%. It’s 70% in 2026, climbing to 80% in 2027 and 90% in 2028. By 2029, it has to be 100% U.S.-made (or made in a free-trade agreement country).

Critical mineral sourcing or recycling: The most challenging hurdle for EVs to clear will be a requirement that the raw materials used in the battery be recycled or sourced in the U.S. or a country that has a U.S. free-trade agreement. In 2023, 40% has to meet the conditions, climbing steadily each year to 80% in 2027.

Additionally, none of the battery components can come from a specifically restricted country. The list currently includes Russia, China, North Korea and Iran.

How do I calculate my tax credit with all these confusing requirements?

You claim this tax credit in the same way as before, on IRS Form 8396. The form includes qualifiers to help you calculate the credit amount. Starting in 2024, as you see below, the dealership may be able to give you a rebate on the spot so it will be much less complicated.

A huge benefit of the bill kicks in starting in 2024: Direct Pay. This change allows car buyers to directly transfer the credit to the dealership so they can include the amount as an upfront discount. Game changer!

Used Electric Vehicles

Used vehicles put into service after Dec. 31, 2023 can receive up to a $4000 tax credit, but the income threshold and requirements are harder to meet for this rebate so it’s more difficult to receive the full amount.

- The credit is worth the lesser of $4,000 or 30% of the sale price.

- The model year of the vehicle must be at least two years earlier than the calendar year in which the taxpayer acquires it

- Vehicle must have a gross vehicle weight of less than 14,000 pounds.

- The transaction must take place through a dealer and carry a sale price of $25,000 or less, and be the first transfer since the establishment of this tax credit.

- The credit is not available for taxpayers with a modified adjusted gross income exceeding: $150,000 for a joint filing, $112,500 for a head of household, or $75,000 for a single filing.

EV Charging Infrastructure Credits

The EV charging station tax credit has been extended through 2032. For individual/residential uses, the tax credit remains unchanged at 30%, up to $1,000. For commercial uses, the tax credit Is 6% with a maximum credit of $100,000 per unit (up from $30,000 per property).

Residential EV Charger Installations: Homeowners who install EV chargers on their property qualify for a tax credit. Here at Ipsun we can install car chargers if you are a solar customer, so reach out and talk to us about this project!

The tax credit covers both hardware and installation costs. The credit remains the same under the new bill: 30% of the project costs up to $1,000. Some new additions include:

- The requirement of paying a prevailing wage for the installation of qualifying equipment and

- Allowing bi-directional charging equipment

Commercial EV chargers: Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30% of the cost. With the passage of the IRA, the maximum amount of the tax credit has increased from $30,000 to $100,000 for projects completed after December 31, 2022. Projects completed before then would still be subject to the $30,000 cap.

The extension also has a few changes for installations completed after December 31, 2022:

- The credit now requires that projects pay the prevailing wage for labor and meet certain apprenticeship requirements.

- It limits the availability of tax credits to installations completed along approved “census tracts,” typically low-income or non-urban areas.

- The act also allows for bi-directional charging equipment, like the chargers shown below at the Bethesda MD School Bus Depot

- Allows for direct payment of the credit amount to tax-exempt organizations like schools, non-profits, and government buildings.

How to get the Federal Tax Credit for EV Chargers

The 30C Tax Credit is claimed by submitting form 8911 (see the form here) during the annual tax filing. The full guidance from the IRS can be reviewed at this site (IRS Guidance 8911).

Just the Tip of the Iceberg

It’s important to remember that the federal tax credit is just one of the incentives available for customers purchasing EVs and installing EV equipment. On top of that credit, you may be eligible for rebates from your state, utility, county, regional organization, or municipality. In fact, 63% of the country currently qualifies for a rebate for installing EV charging equipment. Check this handy site for local incentives to see if you’re eligible.

Give us a call with questions!

Get in touch today to learn more about how the Inflation Reduction Act can save you money — and help you have a hand in saving the planet. Save some cash, fight climate change, win-win!

.jpeg)