Updated 9/2/23: It’s been one year since the passage of the Inflation Reduction Act (IRA) of 2022, and already the law has brought over $100 billion in U.S. solar and storage company investments. The IRA will benefit every American directly or indirectly in many ways, but we’re especially excited about how it will affect you if you have plans to go solar, are looking to electrify your home or transportation, or if you have kids or grandkids and are concerned about their future.

Ipsun, along with climate advocates across the country and with our partners in the Amicus Cooperative, has been working for many years to push legislators to act with the urgency needed to address the climate crisis — and now it has actually happened! Huge kudos to every person who showed up, made calls to their legislators, signed petitions, and did whatever they could to help get this legislation over the line. We did it, woohoo!

Read on to see what this bill could mean for you.

The bill contains $369 billion in funding for clean energy and electric vehicle tax breaks, domestic manufacturing of batteries and solar panels, and pollution reduction. It is the single most important step the US has ever taken to combat the climate crisis and build America’s clean energy economy. It is truly a turning point in the fight against climate change.

As its name suggests, this legislation will fight inflation by driving down energy costs. It will also provide economic opportunity and capacity-building investments in disadvantaged communities, create good jobs, and help the US cut greenhouse gas pollution in line with President Joe Biden’s commitment to a 40% reduction by 2030.

That means it will have an effect one way or another on just about everybody, whether it’s at the gas pump or because your next car will be less expensive or because the boom this will create in US manufacturing will bring economic benefits across the board. But let’s get to our favorite part…

Highlights for Solar, Including a 10-year ITC Extension at 30%!

We are so thrilled, amazed, and energized about everything in the bill, but let’s start with our favorite topic, solar! We’re excited about the benefits for current solar customers, for low- and mid-income people for whom solar may have previously been out of reach, for solar industry workers, and for US solar and green energy manufacturing and technology. Here are a few of the best bits:

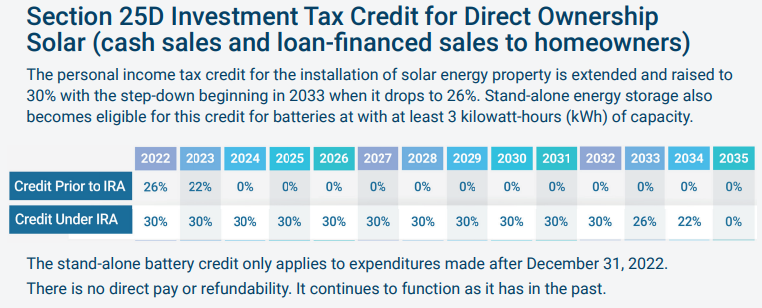

Ten-year Investment Tax Credit Extension: One of the bill’s most impactful provisions is the 30% extension of the federal solar tax credit, known as the ITC, through 2033.

The Investment Tax Credit (ITC) for solar customers has been instrumental in launching the solar industry we know today. In fact, the ITC is considered the most effective climate policy the US has—and extending it is a true game changer.

As UC Santa Barbara Political Science Professor Leah Stokes said in her recent interview on the Volts podcast, “It’s a pivotal moment we’ll look back on in ten years. Obama’s stimulus bill (which created the ITC) was just ¼ the size of the IRA, and it exploded the solar and wind industries. The amount of money we’re investing now will have transformative effects.”

Here’s an overview of the ITC extension, provided by the Solar Energy Industries Association (SEIA):

For a look at how to apply for the tax credit, and what specific changes to the residential solar ITC were created by the Inflation Reduction Act, check out our post about how to take advantage of the new 30% credit.

30% tax credit carryover through 2032: If you don’t have enough tax liability to use the entire credit in one year, you can carry over the 30% credit through the next ten years. In 2033, your carryover will be 26% and in 2034 it’s 22%.

ITC for storage: The bill includes a 30% storage tax credit, including a stand-alone storage credit. This means current solar owners would get a 30% tax credit on a battery storage retrofit.

ITC for service panel upgrades: ,If a service panel upgrade is needed to support the installation of a solar energy system then it qualifies for the 30% tax credit. This includes SPAN panels installed by Ipsun.

Direct Pay for tax exempt orgs: Tax-exempt organizations will be eligible for a direct refund of the tax credit. This is great news for schools, churches, government entitites looking to decarbonize, and for any tax-exempt organization who can better use that money serving their community. Previously, tax-exempt organizations needed to use a Power Purchase Agreement to utilize the tax credit effectively, but this meant they couldn’t own the panels and earn money from their SRECs. Now they can, and we are thrilled to be able to offer an ownership option.

Transferability: Starting in 2023, entities will be allowed to transfer their tax credits to a third-party, effectively allowing them to sell their tax credits for cash to unrelated parties. This is a step in the right direction for individuals or businesses who do not have enough tax liability to make use of the tax credit. We’d have preferred direct pay, but this is at least something.

Domestic content adder: Entities are eligible for an additional 10% domestic content bonus if certifying “domestic content requirements” are met or if the project is located in an energy community that has ties to traditional energy sources.

In fact, according to Ivy Main of the Virginia Mercury, “those adders, available if the facility is located on a brownfield or in an “energy community” (10%), uses domestic content (10%) or serves low-income residents (10-20%), can be combined, making it entirely possible for a solar project on low-income housing in Virginia’s coalfields, built using American-made equipment, to qualify for tax credits of up to 70% of the cost.”

The solar package represents a tremendous boon for the solar industry, our company, and for the everyday people who work daily to build the renewable energy future. The predictability provided by a full ten years of 30% ITC will enable our company to continue to employ people at a good living wage, support their growth in the industry, and care for our team with full benefits and profit sharing.

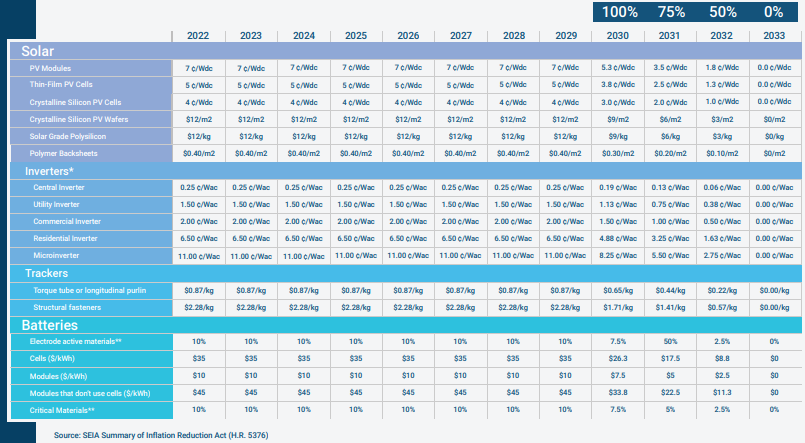

Tax Credits for US Solar Manufacturing

The IRA establishes two credits for manufacturers. A 30% investment tax credit (Section 48C) for eligible investment costs in facilities and equipment and manufacturing production credits for certain components based on the volume of product manufactured.

Manufacturers can only seek to take one or the other; that is, a manufacturer cannot claim the investment credit and then claim the production credit for product from the same factory.

Ten billion dollars are allocated for the Section 48C tax credits, and up to six billion dollars can go to projects located outside of census tracts (or adjacent tracts) where a coal mine closed after 1999 or a coal-fired power plant was retired after 2009.

To receive the full 30% credit, a project must meet prevailing wage and apprenticeship requirements. Otherwise, the credit will be six percent. There is also no direct pay option, with limited exceptions, and manufacturers must apply and be chosen for the Section 48C tax credit.

Manufacturing production credits are also eligible for direct pay for five consecutive years.

The bill covers a lot more than solar, of course. There are exciting benefits for EVs, home electrification, and clean energy tech, which we’ll cover in separate posts. But in general, here are the larger points we’re celebrating:

Reducing Greenhouse Emissions 40% by 2030

The benefits of the IRA have been modeled repeatedly and each projection shows similar gains. That means we can feel confident that this package WILL reduce emissions close to Biden’s 40% goal.

According to an analysis from Senate Majority Leader Schumer’s office, the IRA would cut climate pollution by 40% below 2005 levels by 2030. A separate independent analysis, conducted by the Rhodium Group, offers a 37.5% reduction as its central estimate for emissions reduction by 2030.

A third analysis, conducted by the firm Energy Innovation, found a central estimate of a 39% reduction in emissions by 2030, and that “further, for every ton of emissions increases generated by IRA oil and gas provisions, at least 24 tons of emissions are avoided by the other provisions.” And a fourth analysis, by the Rapid Energy Policy Evaluation and Analysis Toolkit (REPEAT) Project at Princeton University, found that the IRA would deliver a 41% reduction in emissions by 2030.

Economic and Health Benefits for Everyday Americans

Expert analysts also point to this bill delivering massive economic and public health benefits. The IRA would reduce inflation, according to Moody’s Analytics and other economic experts, and help Americans cut their energy costs by $200-$1000 per year by 2030, according to Resources for the Future and Rhodium.

An analysis commissioned by the BlueGreen Alliance, from the Political Economy Research Institute (PERI) at the University of Massachusetts Amherst, found that the bill would grow the workforce by 9 million jobs over the coming decade.

And the Energy Innovation analysis also showed the IRA would help prevent up to 3,900 premature deaths by 2030.

Historic Environmental Justice Provisions

The IRA includes $60 billion for overall environmental justice priorities, more than has ever been spent for communities affected disproportionately by climate change.

$15 billion of that funding goes to a host of priorities like clean energy and emissions reductions specifically for low-income and disadvantaged communities. Community groups, governments, and tribes can also qualify for $3 billion in block grants for programs like cleaning up abandoned mines, monitoring air quality, and improving extreme weather resilience. And the bill contains $3 billion to restore and reconnect communities that are divided by highways.

Questions? Give us a call! But first, cheers!

We’ll continue to study the legislation and provide insight as we learn more. But for now, let’s break out the bubbly and toast to this historic moment. Cheers to everyone in the Ipsun Fam who has called legislators, visited their offices, protested in front of their offices or out in the streets, or used whatever talents you had to contribute to this fight. We did it, fam! Wooohoo and cheers to all of us!