**This post has been updated to reflect the new 30% solar tax credit extension brought by the Inflation Reduction Act (IRA). Read here for more info about the passage of the IRA. You can also check our solar incentives page for the most up-to-date information at ipsunsolar.com/solar-incentives

While tax time may not be the most fun, calculating your solar tax credit shouldn’t be too much of an extra hardship. Especially when it saves you 30% on your solar project! Here are a few handy tips to help you easily apply for your solar energy tax credit.

Gather Your Information and Form 5695

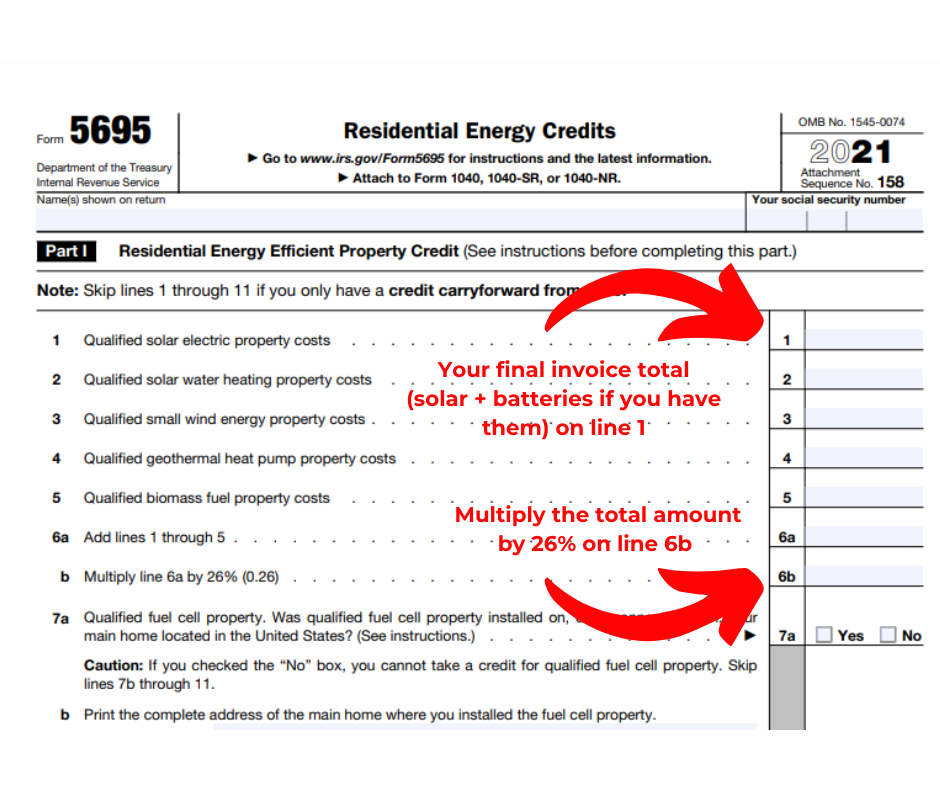

First, you’ll need IRS Form 5695 to calculate your credit. Next, you’ll need your final invoice from us. If you don’t have it on hand, feel free to get in touch with our Solar Support Specialists at [email protected] and they’ll be happy to send it to you.

If the form is not self-explanatory, we suggest you reach out to your tax preparer for advice (since we’re just solar installers, not tax experts). It can get complicated if you have done other green projects, like installing a geothermal heat pump, because they are all calculated on this form. For our purposes, though, you’ll just include your final invoice amount for your solar (and batteries if you have them) on the line indicated on the form and multiply by 30%.

(The screenshot below shows the previous tax credit of 26%–this year’s form will reflect the new 30% credit on line 6b.)

Once you’ve calculated that amount—and if you have no carryforward credit from last year and don’t need to carry over to next year, and also assuming you have no other energy credits to add—then you’ll follow directions to write this amount from line 6b on line 15. Include this amount on Schedule 3 (Form 1040), line 5. Please always ask a tax expert if this is not straightforward for you!

A couple of typical questions people ask are:

1. I have a home office or a business within my residence. Do I still qualify?

According to energy.gov, the answer is yes, but if the residence where you install a solar PV system serves multiple purposes (e.g., you have a home office or your business is located in the same building), claiming the tax credit can be more complicated. This is definitely a case where we advise talking to a tax expert.

When the amount spent on the solar PV system is mostly used for residential rather than business purposes, the residential credit may be claimed in full without added complications. However, if less than 80% of the solar PV system cost is a residential expense, only the percentage that is residential spending can be used to calculate the federal solar tax credit for the individual’s tax return; the portion that is a business expense could be eligible for a similar commercial ITC on the business’s tax return.

2. I financed my solar system. Do I still qualify?

Yes! If you financed the system and are contractually obligated to eventually pay the full cost of the system, you can claim the federal solar tax credit based on the full cost of the system. Miscellaneous expenses, including interest owed on financing, origination fees, and extended warranty expenses are not eligible expenses when calculating your tax credit.

3. Can I deduct the cost of a new roof if I had it installed in order to go solar?

This can be a tricky one. Generally, if the projects happened consecutively it may be possible, and if it is allowed, you can file for these credits on the same paperwork—IRS Form 5695—as you would for your solar system. Roofing costs are not always eligible, though, so we advise consulting your tax expert before you try to include them.

4. What if my tax liability is less than my solar tax credit amount?

If you end up with a bigger credit than you have income tax due—a $3,000 credit on a $2,500 tax bill, for instance—you can carry the credit over to the following tax year. You’ll see instructions for that on Form 5695, but again, we recommend you check with a tax expert to be sure it’s entered correctly.

5. Do I get a tax credit if I installed an EV charger?

Yes! If we installed an EV charger for you, it is covered under the Alternative fuel vehicle refueling property credit. You’ll use form 8911 to apply for the Federal EV charging tax credit.

Reach Out Anytime With More Questions!